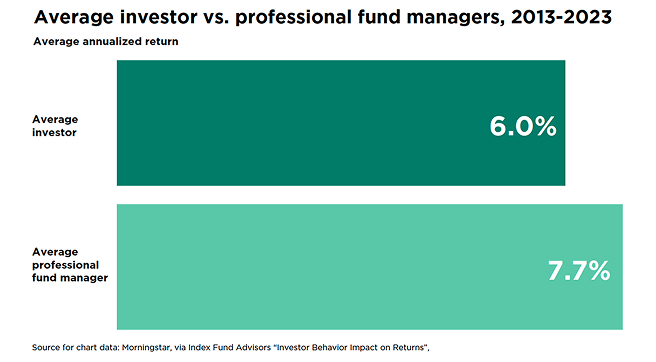

[1] Source: Morningstar, via Index Fund Advisors “Investor Behavior Impact on Returns.”

[2] "Digital News Report 2023," Reuters.

[3] FactSet Research Systems and Nationwide (May 2024).

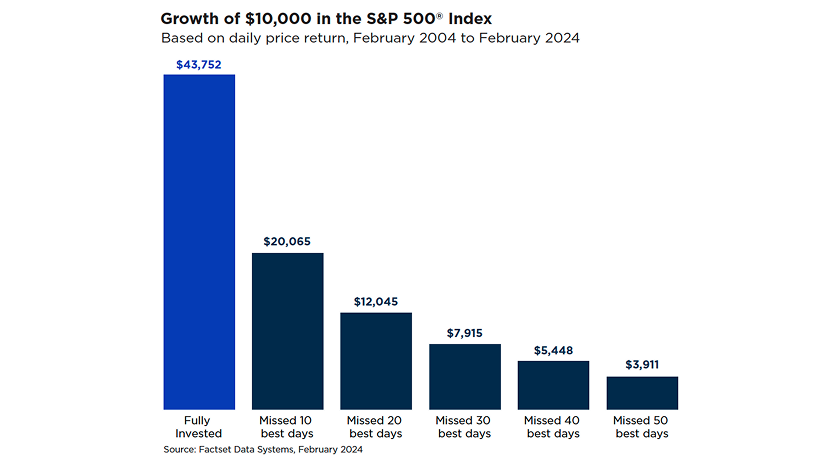

[4] FactSet Research Systems (February 2024).

IMPORTANT DISCLOSURES

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time, and may not come to pass.

Market index performance is provided by a third-party source that Nationwide deems to be reliable. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses have been reflected. Individuals cannot invest directly in an index.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s does not make any representation regarding the advisability of investing in the product.

©2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Nationwide Funds are distributed by Nationwide Fund Distributors LLC (NFD), member FINRA, Columbus, Ohio. Nationwide Investment Services Corporation (NISC), member FINRA, Columbus, Ohio. NFD and NISC are not affiliated with Morningstar, Inc.